Impact on Inflation on Leases and Towers

Tower Development – No Longer Shooting Fish in a Barrel; But…

As a broker for cell towers and cell tower leases, my first question tends to be “what multiple of rent will someone pay for these assets?”

The answer to that question over the last few years has been an easy one: “more than last year.” Between low interest rates, a lack of inventory for sale, and the amount of stimulus introduced to the US economy over the last three years, the valuation of towers and leases has continued to climb during that time. Despite inflation, we haven’t seen a material impact to asset valuation. But there is a question stuck in the back of my head: “how long can this last?”

With inflation at 8.5% over the last 12 months and 4.7% in 2021, it seems like there should be some type of rationalization of tower and lease valuations. Furthermore, while the sale prices for most tower types are very attractive, the actual business of building and operating towers is becoming more difficult and expensive. As a result, I thought I would conduct a deep dive into what it is like to be a tower developer these days. To do so, I contacted the CEOs of four tower developers with portfolios of anywhere from 100 to 1,000 towers. Here are their thoughts (and mine) about the state of the tower industry.

Increased Costs for Tower Developers

- Increased Capital Expenditures for Tower Development

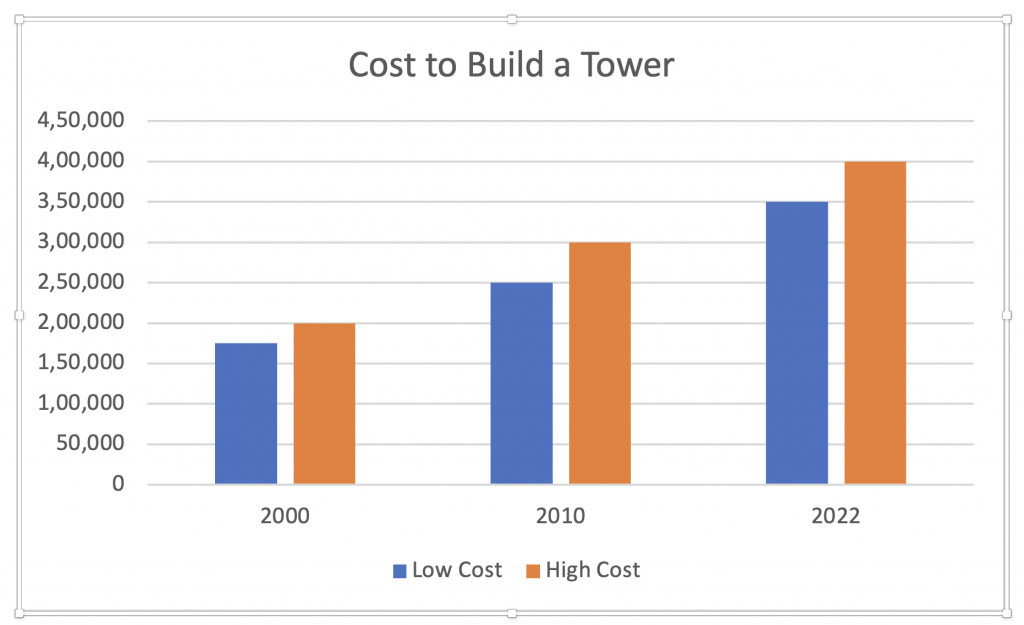

First and foremost, the cost to build towers has increased at a rate that has outpaced inflation over the last 20+ years. The tower developers we spoke with indicated that the average cost of construction of cell towers has nearly doubled over that time. This translates to inflation of approximately 4.5% per year.

There are a few reasons for this. First, carrier loading has more than doubled over that time. Long gone are the days where a carrier would install 6,000 to 7,000 square inches of equipment on a tower. Today’s installations commonly exceed 20,000 square inches and some newer master lease agreements entitle the carrier to install upwards of 40,000 square inches of equipment.

Secondly, the rising cost of materials – especially steel – has had an outsized impact on development cost. One developer indicated that the cost of steel has increased by 50% in the last 5 years. Increased fuel costs impact both tower crews building the tower and the cost of transporting the tower and other supplies to the tower site. Further, tower construction contractors are able to charge more for jobs because there is so much modification and constriction activity related to 5G.

- Increased Operating Expenditures for Tower Developers

On the operating expense side, there are also increased costs. The cost to perform regular maintenance at sites has increased by 10-25% over the last 10 years. Insurance and real property tax expenses have also increased. Furthermore, as towers become older, they require slightly more maintenance and repair. For one developer, maintenance costs have risen by 40% over the last 10 years. Two of the tower developers we spoke with mentioned that land leases have also increased as the typical landowner has better information available to them. Fortunately for tower developers, total operating expenditures for tower operation typically equates to 20% or less of the revenue generated by the tower (except for single tenant towers). So even a moderate increase in operational cost typically doesn’t have an outsized impact on profitability.

- Increased Debt Costs for Tower Developers

As recently as 4 months ago, large tower developers could obtain debt (via a loan) at 3.5% per year. Today, that’s closer to 5-6%. As inflation continues to climb, so will costs – especially for borrowers with variable rates. One tower developer indicated that they are using more equity than debt because the cost of equity is approaching the cost of debt. While the increase in borrowing costs has not impacted tower multiples (yet), it does increase the cost of holding onto towers. For developers that tend to build and flip (sell towers within a few years of building them), the increased cost of borrowing doesn’t have much of an impact. But for developers who plan on holding onto the towers, it’s just one more lever that decreases the profitability of owning and operating towers.

Flat or Lower Revenue for Tower Developers

It is important to distinguish between existing towers and newly built towers for the following discussion. For existing tower portfolios, especially those in areas with even moderate zoning, the tower owner maintains the ability to negotiate fair market value leases. For “built-to-suit” (BTS) towers where the developer builds a tower for a wireless carrier who leases space back from the developer, there tends to be greater competition between tower developers for those opportunities. As a result, the lease rates for anchor tenant collocation leases for a BTS tower have not even remotely kept pace with inflation.

- Lower Rents

By way of example, I looked back at the collocation lease rates that we were charging back in 1997 when I started in the tower business. At that point, our collocation rate for BTS leases and for collocation leases was between $1,650/mo. to $1,750/mo. Today, some tower companies are entering into BTS leases with the Big Three wireless carriers for rates that are lower than $1,650/mo. At the low point in the market a few years ago, one company was agreeing to $800/mo. for an anchor tenant collocation lease. In other words, not only has the market for BTS leases not kept pace with inflation – it has receded.

Even non-anchor collocation leases (2nd sublease tenant on the tower) have failed to keep pace with inflation. Lease rates today for collocations on existing towers are typically in the range of $2,000/mo. with more expensive construction sites commanding slightly higher rents of $2,500/mo. The difference in today’s rates compared with what we were getting in 1997 suggests that collocation lease rates have increased by less than 1% per year over the last 25 years.

- Lower Escalation

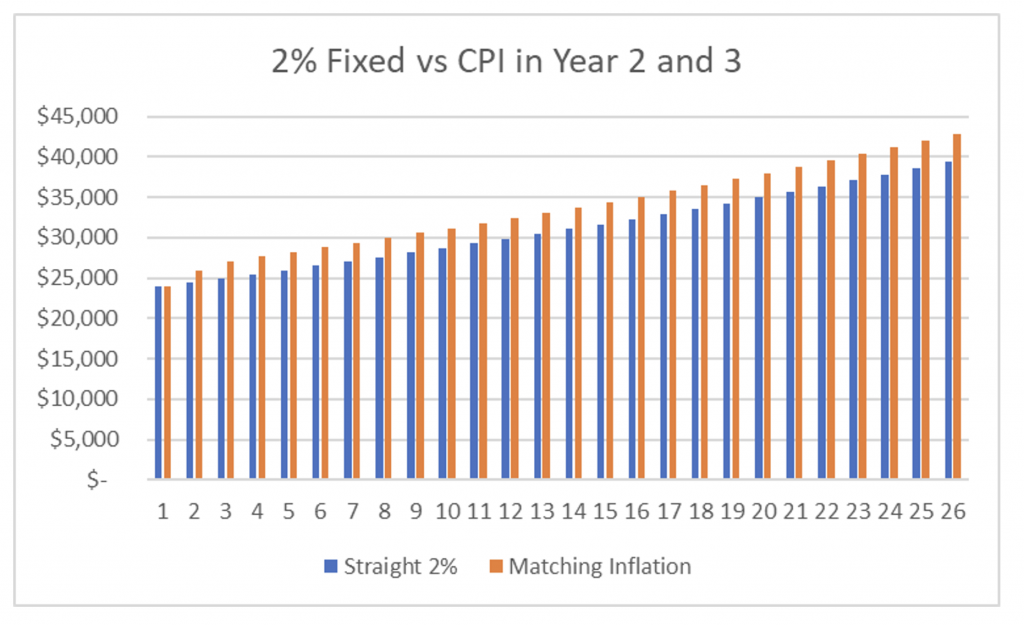

To the further detriment of tower developers, wireless carriers have been aggressively negotiating down the escalators in leases. Long gone are the days of a Consumer Price Index-based escalation. Most collocation leases today have flat escalation of 2% per year while DISH has been pushing 1% per year escalation in its collocation leases (and getting it).

While escalation may not seem like it has a significant impact, consider what happens over time. Take for example the following two scenarios.

- Standard collocation lease at $2,000/mo. with 2% per year escalation

- Standard collocation lease at $2,000/mo. with 2% per year except for the last two years

Any idea how much of a delta there is in overall income over 25 years for these two scenarios? Scenario two will net the tower developer an additional $68,000 over the course of the lease – all because of the significant inflation we are facing in only the last two years.

- High Rent Relocation

If flattening lease rates and lower escalation weren’t enough for tower developers to contend with, they also must address possible relocation of higher rent leases on their towers. One need only look at Tillman Infrastructure and its rise to the top of tower developers in the country by number of towers (1700) in just 6 years to understand the impact. Tillman is one of a number of tower companies who are willing to build new towers near existing towers in order to relocate AT&T or another wireless carrier. The net result is a few thousand existing collocations that have moved to nearby towers. We believe that the threat of relocation has negatively impacted some tower companies in that they have either had to agree to lower rents on individual leases or had to negotiate more favorable master leases with the carriers to prevent relocation.

Tower Development Is Still a Great Business

To be fair, the tower development business is still a great business to be part of. Despite the increased costs and lower revenue per lease, it’s hard to be jaded about being a tower developer. Due to increased competition for assets, limited availability of quality portfolios, previous very low borrowing costs, and the impact of new entrants into the market chasing lower yields, values for towers have never been higher. Every developer I spoke with confirmed my suspicion that the increased costs/lower or flat lease rates hadn’t reduced their desire to develop towers. Some were pickier in choosing which BTS opportunities they pursued, but they were all still actively looking for more opportunities.

If interest rates stay elevated, perhaps we see some belt-tightening or some rationalization in terms of lease rates and escalation, but under the current market it is difficult to see that there will be much change to the current equilibrium. Wireless carriers are getting more for their leases while tower companies still generate outsized returns when selling their portfolios.

The business of tower development may be harder than it has been historically, and developers may need to be pickier on the opportunities they choose. (If you want to know more about the criteria that tower buyers evaluate when pricing a portfolio- please see this article on what tower buyers want in 2022.) Absent a significant downturn in the economy, there are (and will be) no shortage of companies interested in developing and owning towers. Nor will it be difficult to find buyers for those towers once they are developed.

It just won’t be as easy as it used to be.